Cite this article: Interparcel. (2025, March 27). US tariff changes affecting SME businesses. https://au.interparcel.com/blog/shipping-advice/us-tariffs-affecting-sme-businesses

Key insights from Interparcel’s survey:

- 44.41% surveyed businesses are involved in international shipping

- 40.16% of international shippers still rely on Chinese manufacturing, making them more exposed to rising tariffs

- 24.40% of international shippers identified the USA as a key export market

- Among businesses trading with or through the US, 37.71% were impacted by the tariffs

How US Tariffs Are Disrupting Australian eCommerce

Trade tensions between the US and China have become more than just headlines, they’re now impacting small & medium-sized businesses in Australia. Recent tariff hikes stemming from Donald Trump’s trade policies introduced a 10% tariff on Chinese manufactured products effective February 4, 2025, followed by an additional 10% increase on March 4, 2025, resulting in a total 20% tariff on Chinese goods entering the U.S.

For Australian ecommerce businesses, especially those that rely on Chinese manufacturing and sell to the US, the squeeze is already being felt in the form of rising costs, shipping complications, and disrupted growth strategies.

To better understand these challenges, we surveyed 382 small and medium sized businesses in Australian across multiple industries. The results are clear: US tariffs are hitting closer to home than many expected.

The Data: What Our Survey Revealed

Where Businesses Ship Their Parcels?

Out of those surveyed:

- 55.59% ship domestically only

- 40.34% ship both domestically and internationally

- 4.07% ship internationally only

This shows that nearly 44.41% of SME Aussie businesses are involved in international shipping.

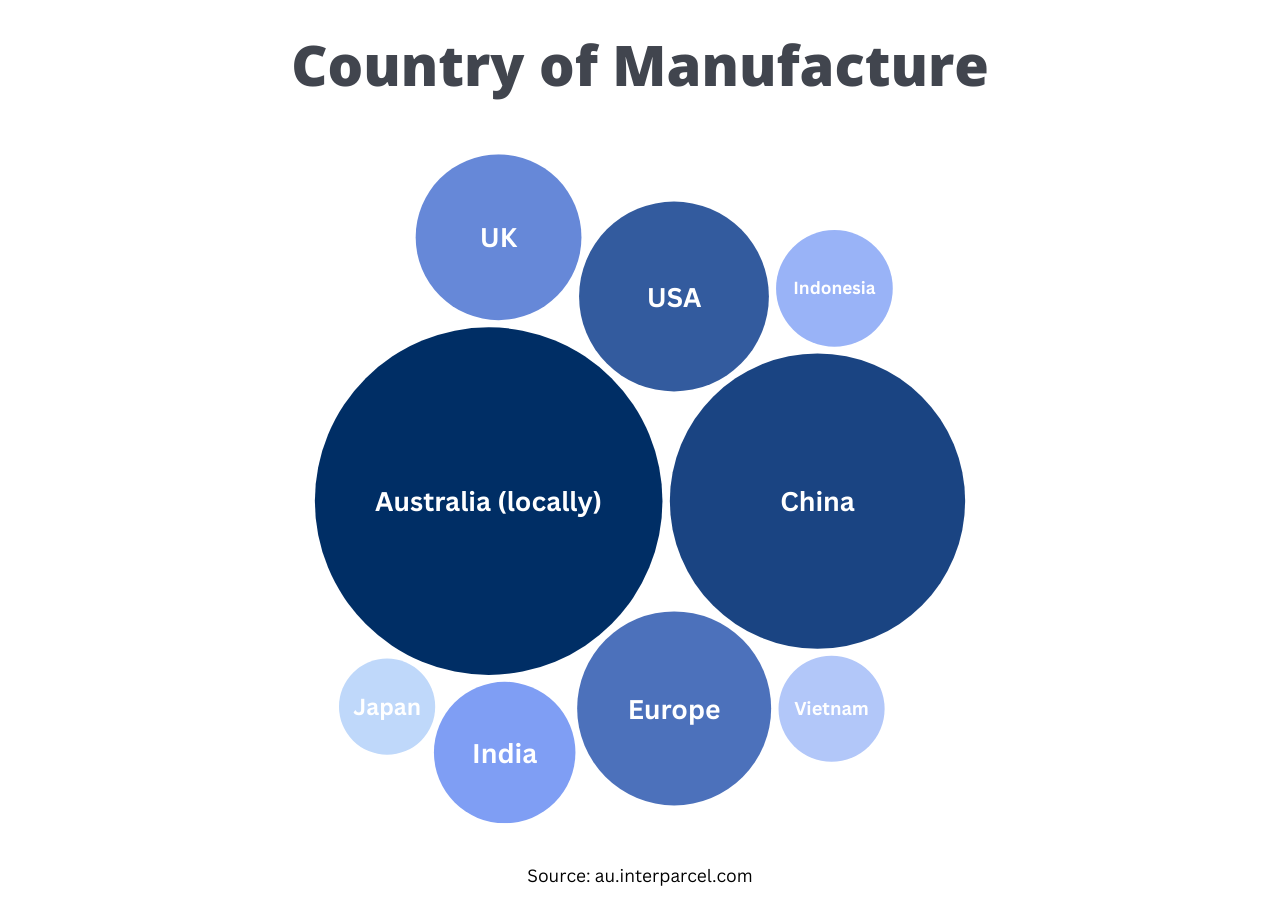

Where Businesses Manufacture Their Products?

Of those who ship internationally:

- 59.84% manufacture locally in Australia

- 40.16% source products from China

- 12.30% manufacture in the US

Other notable mentions:

- European Union - 13.11%

- India - 4.92%

- UK - 8.20%

- Indonesia, Vietnam, Japan - around 1%-2% each

Aussie-made goods are slightly more insulated, but a significant portion still relies on international sourcing, exposing them to rising production and freight costs.

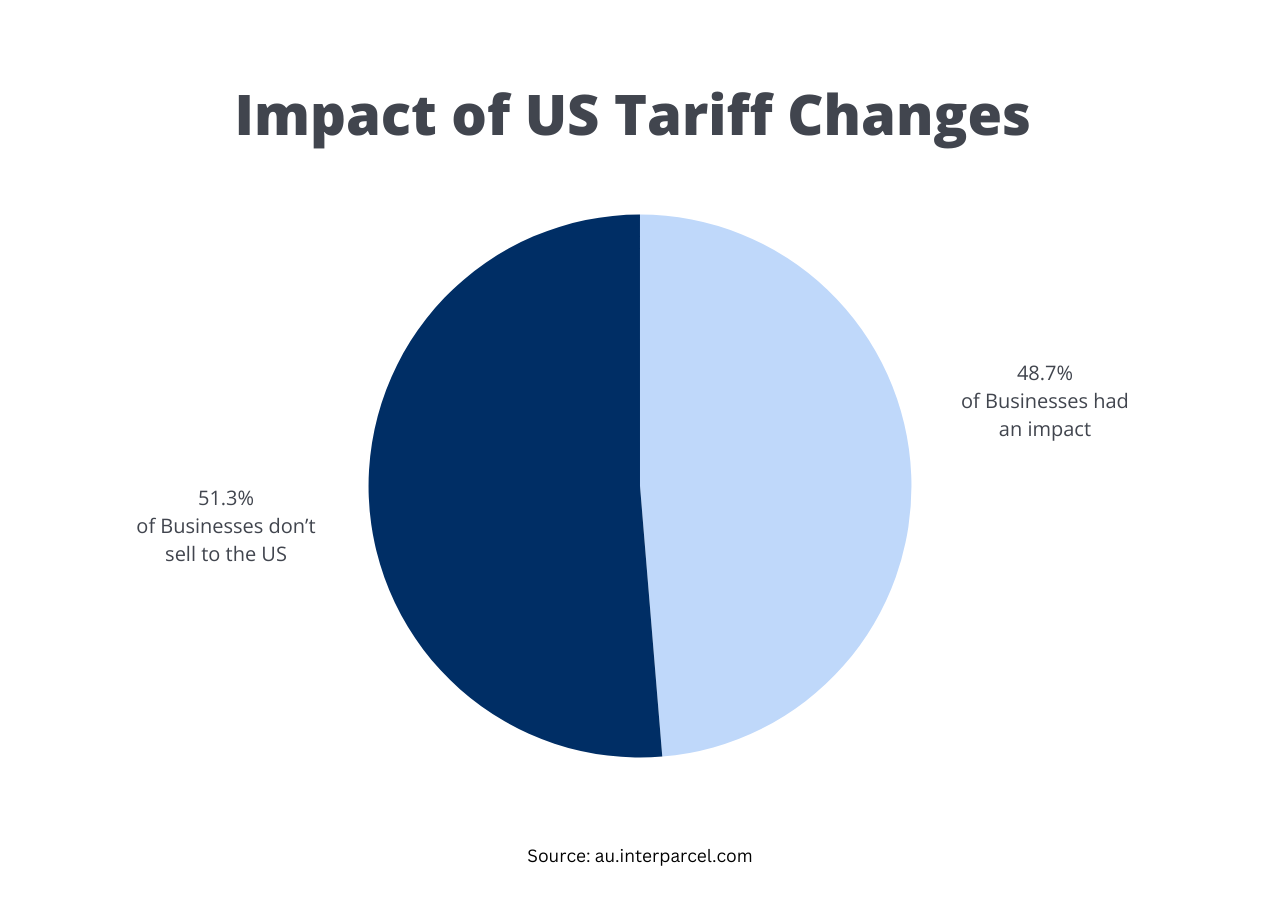

How The US Tariff Changes Impact Business Operations

Among those who trade with or through the US:

- 25.41% say the tariffs had a minimal impact

- 9.84% report a moderate impact

- 2.46% have seen a major impact

- 51.64% say they don’t sell to the US

Real-World Effects of US Tariffs on Daily Business Operations

These written responses offer a closer look at how tariffs are disrupting day-to-day operations for Australian retailers. Here’s what some had to say:

“Costs to import have increased drastically to the USA.”

“Our U.S. sales will now be affected by the 25% tariff.”

“It’s harder to get the components we need.”

“We’re reconsidering bulk shipping to the U.S.”

Where are Aussie businesses selling internationally?

Among respondents who sell overseas:

- USA is the top export destination (21.40%)

- New Zealand follows closely (20.40%)

- UK (14.30%), EU (12.10%), and Canada (6.40%)

- Other regions include Singapore, South Africa, India, and China.

These numbers show that America remains a key market for Australian sellers. So tariff changes in the US will continue to have downstream effects.

Navigating Trade Disruption in eCommerce

While US tariffs may not be avoidable, they are influencing how Australian retailers approach sourcing, pricing, and market expansion. Some businesses are exploring alternative manufacturing regions, while others are shifting focus to different export markets where margins are less impacted.

These strategic pivots reflect a broader trend: eCommerce businesses are becoming more deliberate in how they manage international growth, balancing opportunity with risk. Through ongoing conversations with eCommerce retailers, we’ve seen that those who regularly assess their international operations, especially during periods of policy change, are better positioned to adapt when conditions shift.

Facebook

Facebook Twitter

Twitter Instagram

Instagram Linked In

Linked In YouTube

YouTube