How to add your IOSS Number to your shipments

On the 1st July 2021, the European Union (EU) made the following customs changes that affect businesses sending goods to EU countries:

- Removal of the €22 VAT-free threshold: VAT will be charged for all transactions involving goods and services.

- Introduction of Import One-Stop Shop (IOSS): a new system for reporting and collecting VAT on B2C sales of low-value goods imported from non-EU countries.

Read more on these change here.

Add your IOSS Number

Interparcel provides you with two ways to add your IOSS number to your documents.

- On check out

- Connect to your account

To add IOSS number at checkout

Step One

Get a quote, enter in the details of your parcel and which EU country you want to send it to.

Step two

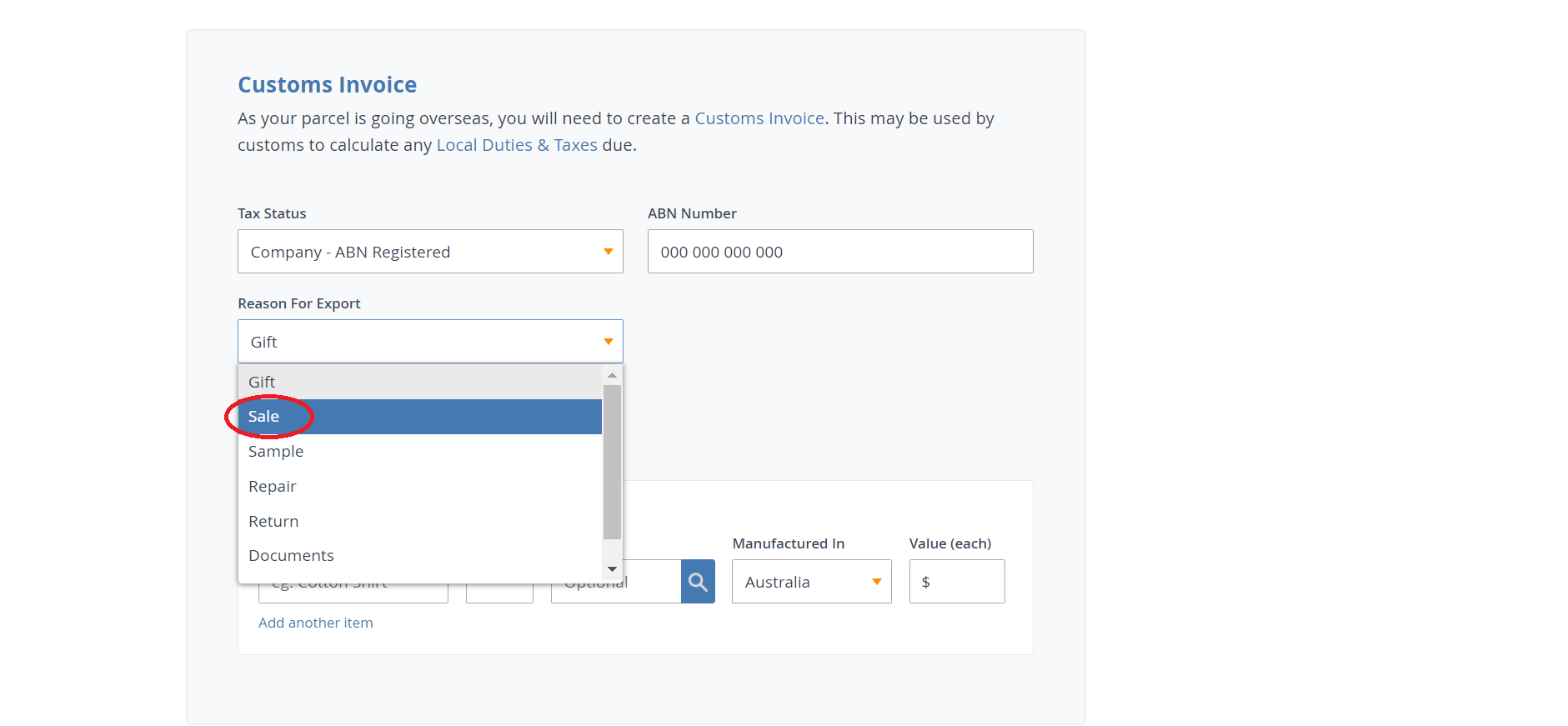

Enter in the collection details, delivery details and collection time. Scroll down to 'Customs Invoice'. Here when you select the reason for export as 'sale'; this will give you the option to enter your IOSS number. Please see step three.

Step Three

Enter the relevant IOSS number here.

Add your IOSS Number to your account

Step one

Sign into your Interparcel User Account and navigate to 'My Account'; and select 'Settings'.

Step two

Select 'International' on the dashboard.

Step Three

Scroll down the page until the heading 'IOSS Number', here you can input your IOSS number which will then be associated with your account going forward.

.png)

As always our customer service team is on hand to answer any questions you may have. You can contact them here.

If you need any more details on the new VAT rules, please see here, or contact your registered Tax Agent.

Facebook

Facebook Twitter

Twitter Instagram

Instagram Linked In

Linked In YouTube

YouTube