Last Updated: 24 February 2026

There has been a major legal shift in the U.S. over the last 48 hours. While Australian businesses have already been paying a 10% tariff for some time, the rules governing those payments have just changed.

In this guide, we’ll walk you through:

- 🚨 The Latest News (February 2026)

- August 2025 Update

- How This Affects International Shipping

- What You Can Do to Minimise the Impact

Please note: While this guide is here to help you navigate the latest tariff changes, every business and shipment is different. We recommend cross-checking your specific shipping requirements or seeking professional advice to ensure everything’s in order before sending goods internationally.

🚨 The Latest News (February 2026)

1. The "New" 10% Surcharge (NOW ACTIVE)

As of 12:01 a.m. EST today, February 24, 2026, the U.S. has officially transitioned to a new tariff system. This follows last Friday’s Supreme Court ruling that the previous "reciprocal tariffs" (imposed under the IEEPA law) were illegal.

- The Result: The U.S. government has immediately replaced the old tariffs with a "Temporary Import Surcharge" under Section 122 of the Trade Act of 1974.

- What stays the same (for now): For most Australian goods, the tax rate remains at 10% today.

- What is different: As of today (February 24), the 10% tax is officially being collected under a new law. While the cost is currently the same, this new tax is legally set to expire in 5 months (July 2026). However, the U.S President has already announced plans to increase this rate from 10% to 15% very soon.

*Under Section 122 of the Trade Act of 1974, the U.S. President has the power to bypass Congress and immediately add a "surcharge" to imports. However, the law has two very strict "speed limits":

- The Rate Limit: The tax cannot be higher than 15%.

- The Time Limit: The tax cannot last longer than 150 days (about 5 months).

After 150 days, the tax must expire unless the U.S. Congress votes to keep it going.

2. Trump's Social Media Update: Potential Hike to 15%

This is the most critical part for your margins. On Saturday, Trump posted on social media that he intends to increase this new global surcharge from 10% to 15%.

- UNCONFIRMED: While the 10% rate is officially signed, the jump to 15% has not yet been finalised in official paperwork.

- TODAY’S STATUS (Feb 24): As of this morning, U.S. Customs (CBP) has officially switched to the new Section 122 system. While systems are currently processing at the signed 10% rate, the 15% Executive Order is expected to be signed at any time. We will send an email to our customers if that happens.

- The Risk: If this change goes through, Australian exports will effectively become 5% more expensive overnight. We recommend reviewing your pricing now in case this 15% rate is confirmed this week.

3. The $800 "Tax-Free" Rule (Still Suspended)

You may remember that the U.S. removed the $800 duty-free limit (De Minimis) back in August 2025.

- The Update: There was hope that the Supreme Court ruling might bring back tax-free shipping for small parcels. However, on February 20, the U.S. government signed a new order to keep this suspension active.

- The Reality: Every package you send from Australia, no matter how small, continues to be subject to duties, taxes, and full customs paperwork.

4. Are You Owed a Refund?

Because the Supreme Court ruled the previous 10% tariffs illegal, there is a chance that Australian businesses (or their U.S. customers) could claim back the taxes they paid over the last year.

- Status: This is currently unconfirmed. The U.S. government has not yet released a process for refunds, and experts warn it could be a very long legal battle to get that money back.

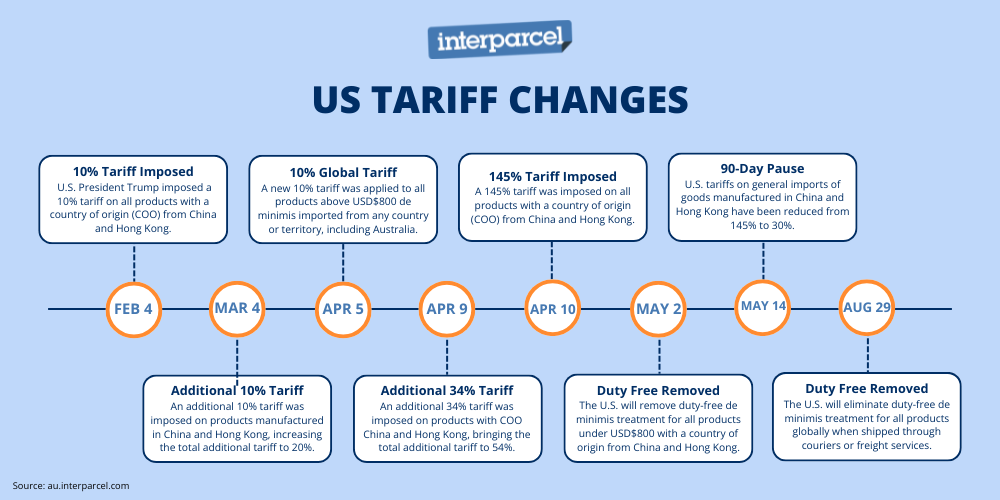

August 2025 Update

Effective August 29, 2025, the U.S. government has suspended the duty and tax-free exemption for imported goods valued at or below USD $800. This change applies to all countries, including those previously exempt.

The U.S. will eliminate duty-free de minimis treatment for all products globally when shipped through couriers or freight services.

What this means for low-value shipments:

- All shipments valued at or under USD $800 will now be subject to applicable duties and taxes.

- These shipments will require formal or informal customs clearance by a licensed customs broker.

- Customers must provide accurate and complete shipment information to avoid delays.

- Processing times may be longer due to the additional clearance requirements.

- Duties and taxes must be paid according to standard entry and payment procedures.

Please Note: Goods imported from Hong Kong and China have already been subject to duties since May 2025.

How the New U.S. Tariffs Will Impact Your Shipping

If you’re selling to customers in the U.S., the suspension of the duty-free De Minimis exemption is a game-changer. Until now, parcels valued at $800 USD or less could enter the U.S. without paying duties or taxes. But from August 29, 2025, that benefit will no longer apply to shipments sent via couriers, express services, or freight forwarders.

This means that every shipment to the U.S., no matter where your products are made or how low their value is, will now be subject to U.S. duties and taxes. For Australian retailers, this translates to higher landed costs, which could directly impact your pricing strategy, profit margins, and even the competitiveness of your offering in the U.S. market.

Beyond the financial hit, you should also prepare for longer customs clearance times. The new regulations will trigger more detailed inspections and stricter enforcement, leading to potential delays in delivery. If speed and reliability are key selling points for your U.S. customers, this could affect customer satisfaction and return purchase rates.

In short, these changes will force many businesses to rethink their pricing models, supply chain workflows, and fulfilment strategies. Now is the time to review how these new costs and delays will affect your U.S. operations, and explore solutions like adjusting shipping methods, consolidating shipments, or absorbing costs in your pricing.

What You Can Do to Minimise the Impact

1. Get Your Commercial Invoice Right for U.S. Shipments

Accurate and complete commercial invoices are essential when shipping to the U.S., not only to avoid customs delays and inspections, but to ensure your goods aren’t overcharged with duties or refused entry.

Here’s what you need to know:

For all shipments to the U.S., make sure your commercial invoice includes:

- Sender and receiver details

- Your Tax Status

- Reason for Export

- Required Identification Numbers

- For each product:

- A clear, specific product description (what is it and what's it made of?)

- Quantity

- A 10-digit HS Code (check here to find the correct code and watch this video to learn more)

- The country of manufacture

- The product’s value and currency

Additional requirements to be aware of:

- A Manufacturer Identification Code (MID) is typically needed for textile products for commercial use. If required, you can add this in the product description. For more information on what products require a MID code and how to generate it, click here: MID Information.

- Formal entry for high-value shipments: If your shipment is valued over $2,500 USD, it will require formal entry and must include an EIN (for businesses) or SSN (for individuals). You can include them in the product description when shipping with Interparcel.

For more detailed guidance, visit FedEx’s U.S. tariff and shipping information page.

Getting your commercial invoice right the first time ensures smoother customs clearance and helps avoid costly delays and fees.

2. Communicate Proactively with Your Customers

Unexpected delivery fees or delays can impact customer trust, especially during peak sales periods.

With the new U.S. tariffs in place, many products are now subject to stricter documentation checks at customs. These inspections can lead to unexpected delays or added fees if the paperwork isn’t perfect.

What you can do:

- Add a note at checkout about potential delays or fees on U.S. orders

- Update delivery estimates on your product pages and in shipping notifications

- Email customers to explain any pricing or shipping changes

Transparency goes a long way in retaining customer loyalty, especially when shipping timelines or costs may be affected by forces outside your control.

3. Diversify Your Export and Manufacturing Strategy

Reducing reliance on high-risk supply chains can protect your business long term.

Consider:

- Exploring less-affected export markets (e.g. New Zealand, the UK, Canada)

- Building relationships with alternative manufacturers in Vietnam, India, Indonesia, or Australia

4. Recalculate Pricing to Protect Your Margins

With tariff costs rising, it’s recommended to revisit your pricing strategy.

What to consider:

- Factor new import duties into your landed cost calculations

- Reassess your product margins, especially for U.S. customers

- Decide whether to absorb the cost, pass it on, or split it with the customer

You may also want to explore tiered pricing, bundle deals, or volume discounts to stay competitive without sacrificing profitability.

5. Access Australian Government Support

The Australian Government is offering guidance and tools to help businesses affected by tariff changes:

- Export Market Development Grants (EMDG)

- Business advisory services

- Educational webinars

Explore: Government Support for Exporters

If you have any questions about how these changes impact your shipments to the U.S., our customer support team is here to help. Contact us for expert guidance on navigating these new regulations and ensuring smooth international shipping.

Facebook

Facebook Twitter

Twitter Instagram

Instagram Linked In

Linked In YouTube

YouTube