Managing your import freight shipping means planning for variables that you know will affect cost. But sometimes, you may be assessed charges that you weren't expecting, or that you don't think are correct.

Filing a claim can be a strenuous process, often involving time-consuming communication back and forth with your provider.

That's why we've created this article to answer all your questions about navigating import freight claims. We’ll cover the different situations that result in a dispute and how to lodge a claim with Interparcel.

Here’s what you need to know.

Significance of Managing Claims

A freight claim should be treated seriously. While they go by names such as shipping claims, transportation claims, or cargo claims, they are a critical aspect of business operations.

Large volumes of claims impact profit margins and revenues. Businesses should take the necessary steps to minimise shipping disputes. Even a minor percentage of lost profits from a significant number of claims can affect financial outcomes.

Plus, you may gain a negative reputation within the industry for raising multiple freight claims. Before submitting a dispute, attempt to address matters with support teams. It may be more financially beneficial and protect your brand in the logistics network.

What is a Shipping or Carrier Claim?

A freight claim is a formal request to a carrier for financial compensation due to the loss or damage of a shipment during transit.

Also known as cargo claims, transportation claims, shipping claims, or loss-and-damage claims, the ultimate goal is to resolve the issue. It holds the carrier accountable for the obligations outlined in the original bill of lading.

What Are the Types of Disputes?

When it comes to importing goods in Australia, there are typically four types of disputes that arise as a result:

- A misdeclaration of the weight and dimensions of your parcel;

- Unknown customs duties and taxes that the importer has had to pay;

- A dispute about goods and services tax (GST) payable;

- Any item that is not fully encased or packaged appropriately, and therefore, has accrued an additional handling charge from the carrier.

1. Weight and dimension charges

If your parcel is larger or weighs more than declared during the booking you paid for, the carrier may issue an additional charge. You will be invoiced for the difference once we receive the courier's audit of the weight and dimensions.

You can contest the courier's audited weight and dimensions if you disagree with them. However, you will need to provide photographic evidence to support your claim.

- If you have been billed on dimensions, we need images of the item, showing each side measured with a measuring tape. The photos must be clear enough for us to read the measurements point to point. The label also needs to be visible.

- If you have been billed on the weight, we need photos of the item showing its weight on a set of scales. The label also needs to be visible.

We recommend that for all freight charges in dispute, customers provide photographic evidence of weight, length, width and height regardless of what the discrepency is between the booking and audited information from the carrier.

How to Weigh and Measure My Parcel

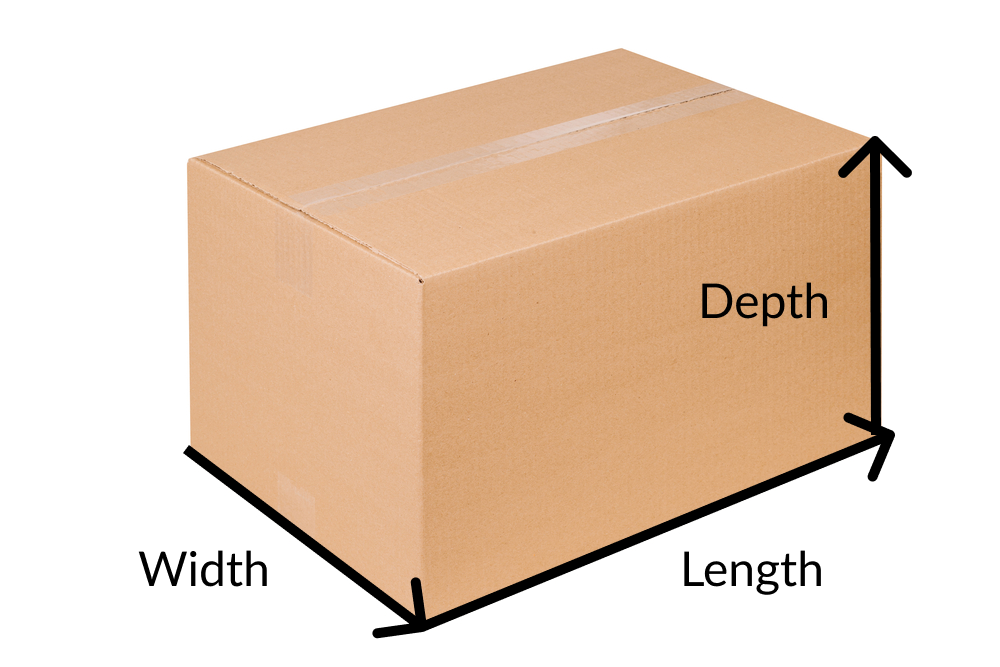

When you make a booking, you will be prompted to enter the precise weight in kilograms and the dimensions of your parcel in centimetres. You will need to indicate the three dimensions of your shipment - length, width and height.

The quickest and most accurate way of doing this is using a ruler or measuring tape to obtain the package's widest, longest, and deepest point.

Make sure you’re using a strong box when packing your parcel. This will allow you to measure the dimensions of your parcel accurately, and avoid any damage during transit which may alter these dimensions.

You must measure accurately to avoid additional freight charges. Be sure to enter the exact weight and dimensions of your package.

If you have entered the incorrect weight and dimensions when booking, we recommend calling our customer service team to cancel and re-book your shipment before it is collected. If so, replace the incorrect label with the amended one from your new booking.

2. Customs duties and taxes fees

When you import goods into Australia, you generally will be charged the following duties and taxes. Please note that the below amounts are guidelines and may be subject to change:

- Import entry and processing costs:$200 or less

- Customs import duty: calculated as a percentage of the price originally paid for the goods. Typically ranges from 0%-10%, but for most products imported into Australia, this is 5%

The importer is responsible for paying the customs fees for their country when they purchase goods.

There are 2 common issues to be aware of during the importation of goods:

- The importer has declared the incorrect value of the goods. For more information on how to calculate the value of your goods click here.

- The imported goods are exempt from duties and have been incorrectly charged.

In this case, Interparcel will raise an invoice for the duties and taxes based on the assessed charges by Australian customs. If these charges are incorrect and you wish to dispute them, please advise the Interparcel Billing Department at billing@interparcel.com.au

- Tariff code

- A certificate of origin

- Supplier invoice

- FTA

Goods and Services Tax Payable

You will be charged a Goods and Services Tax (GST) on most imported goods in Australia. This is 10% of the final amount and is based on the value of the goods, the transport, insurance, and duty charges (if applicable). There are two situations where an importer will dispute the GST payable:

- Your supplier has charged GST for their import as well as for the product that you bought. This is effectively double-dipping from your supplier and should be taken up with them.

- If you are an importer and registered for GST, you may be able to defer the payment of GST by participating in a deferred GST scheme. For more information click here.

Manual Handling Processing Fee (MHP)

There are a number of surcharges that differ between carriers for additional handling of packages. This includes but is not limited to the following as they disrupt the carrier sorting process:

- Any item not encased in corrugated cardboard or a suitable packaging material.

- Any labelling like "fragile", "handle a certain way", or "plastic bags".

- Items of unusual shape and composition such as drums, tubes, wooden crates, liquids, glass, highly fragile items and dangerous goods.

- Any cylindrical item.

Key Freight Claim Laws and Regulations

The transport, postal and warehousing industry is highly regulated. They must abide by both state and federal legislation. Some of the most important are:

- Competition and Consumer Act 2010: This law safeguards against anti-competitive behaviour and ensures consumer protection by prohibiting unfair business practices.

- Australian Consumer Law (ACL): Establishes consumer rights and guarantees concerning goods and services, unifying consumer protection laws nationwide.

- Australian Privacy Act 1988: Regulates the handling of personal information by businesses and organisations, governing its collection, use, and disclosure.

- Australian Privacy Principles (APPs): Comprising 13 standards, these principles define the necessary criteria for businesses and organisations when managing personal information.

- Road Transport Legislation: A comprehensive set of laws and regulations overseeing the transportation of goods and passengers on Australian roads.

- Australian Road Rules: Form the basis for road rules across Australian states and territories derived from model laws.

- Heavy Vehicle National Law Regulations: Enforce the Heavy Vehicle National Law, setting national standards for the operation and management of heavy vehicles.

- Australia's Measurement System: The national measurement system employed in Australia is structured on the metric system.

How to Submit a Carrier Claim

To initiate a claim with Interparcel, contact our friendly customer service team. Before you get in touch, have these documents and details to assist them.

For damaged goods:

- A completed Claim Form

- Photographs of the damaged item/s upon receipt

- Photographs of both internal and external packaging materials

- A copy of the cost invoice from your supplier or wholesaler

- An invoice or quote specifying repair costs

- A comprehensive description of the damage incurred by the item

For lost goods:

- A completed Claim Form

- A copy of the cost invoice obtained from your supplier or wholesaler

Only the registered sender, typically the person who placed and paid for the order, can initiate a claim. You must provide the parcel's original packaging and photographic evidence to proceed. Retaining the packaging is crucial if an inspection is necessary; without it, the claim might be invalidated.

For lost parcels, the submission window for a claim is 28 days, while for damaged packages, it must be made within a maximum of 10 days after receipt.

In the event of a damaged item, avoid moving it until the process is finalised, as it may nullify the claim. If you’re fully compensated, the item will not be returned. However, in cases where repair costs are covered, the item will be returned at your expense. A collection for this return is not required.

What to Expect During the Claims Process

Additional charges and disputes happen. At Interparcel, we deal with them in two different ways:

- If it is a freight charge, you will receive an email with a link to the invoice outlining the additional costs and your payment options. If payment is made within seven days, a reduction in the admin fee will be offered. Any payments made after seven days will incur the full admin fee.

- If it is an outstanding customs charge, you will be issued an invoice link via email for payment to be made the same day. A Customs Entry copy is emailed separately to the invoice link for your reference. Failure to make payment within the same day will automatically flag your invoice as overdue.

All disputes will be issued to Interparcel with supporting evidence and not the carrier directly.

Optimise and Scale Your Claims Process

Managing carrier claims is an intricate and time-consuming aspect of fulfilment operations. While they demand attention and resources, they are vital for reducing costs, addressing shipping issues and maintaining relationships with customers and couriers.

Streamlining the process ensures timely submissions and adequate reparations. You could manage this yourself and contact individual couriers. However, when you make a booking with Interparcel, our team has direct access to carriers and can quickly get the answers you need.

Where to Get More Information on Carrier Claims

Freight losses or damages during transit can significantly impact your finances. There are also potential business disruptions and delays they may cause.

To reduce the occurrence of freight claims, take preventive measures such as using high-quality packaging materials, ensuring clear and accurate labelling, securing transit insurance, and maintaining comprehensive records of all your fulfilment activities.

Keeping thorough records, encompassing tracking numbers, dates, times, addresses, and contact details for carriers and customers, is vital. These meticulous details will serve as a valuable resource in the event of any issues or challenges with the shipment.

If you need further assistance or have more questions about carrier claims, contact our customer service team via email, live chat or phone at 1300 006 031.

Facebook

Facebook Twitter

Twitter Instagram

Instagram Linked In

Linked In YouTube

YouTube