Cite this article: Interparcel. (2025, September 2). What is the Most Common Method of Transporting Goods Worldwide? (With Stats & Industry Insights).

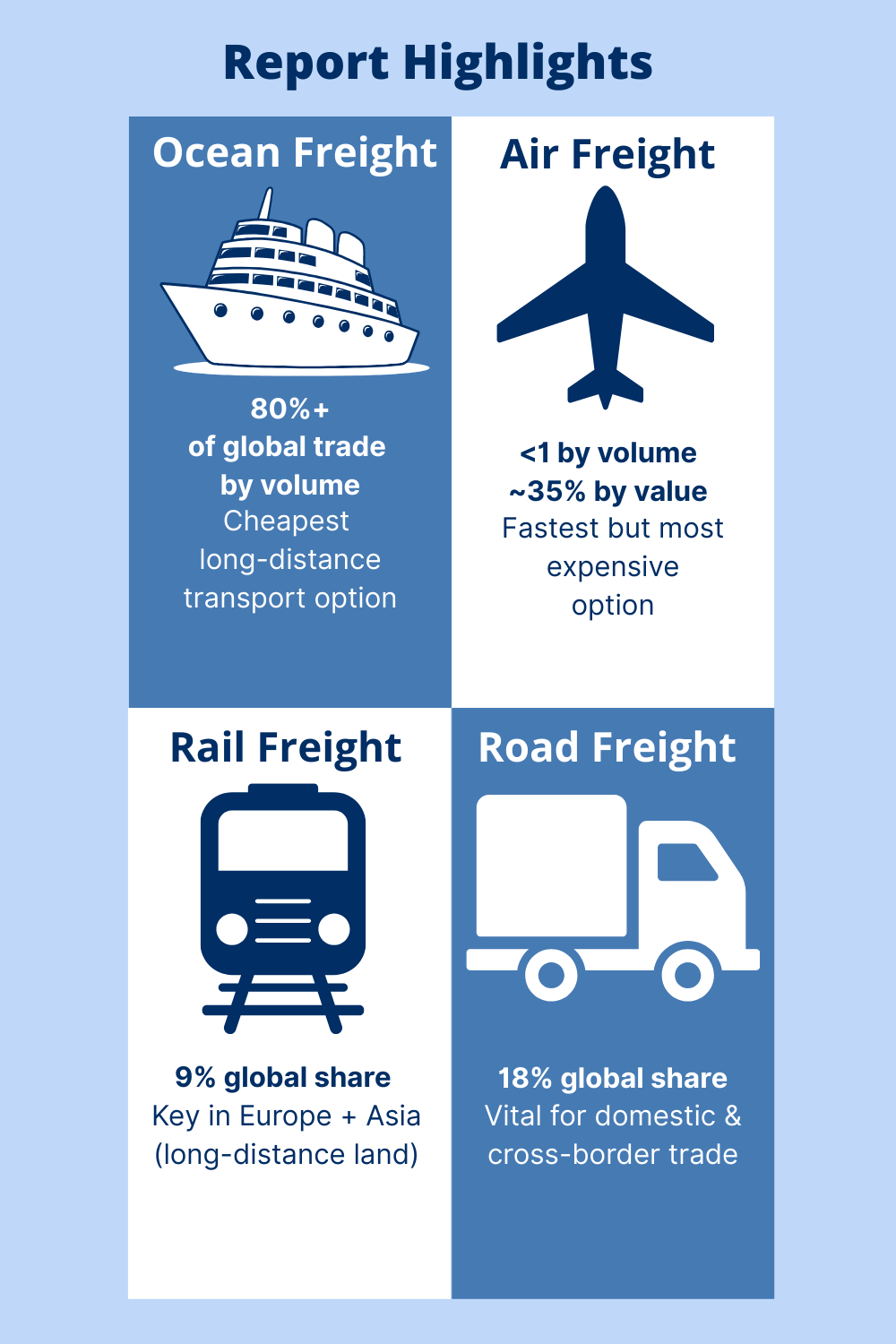

Report Highlights:

- Over 80% of global trade by volume is transported via ocean shipping.

- Ocean freight remains the most cost-effective way to move large volumes across continents at scale.

- Air freight, while faster, carries <1% of trade by volume but ~35% by value.

- Rail and road freight are essential for domestic and regional transport and continue to grow in key markets.

- The rise of ecommerce and logistics tech is reshaping global freight with new efficiency and visibility standards.

Every product we buy, from smartphones and clothing to groceries and furniture, takes a complex journey through global supply chains before it reaches us.

These goods move across oceans, through airports, over railway lines, and along highways.

But have you ever wondered: What’s the most common method of transporting goods worldwide?

The short answer is ocean shipping. And the numbers behind it are staggering.

In this article, we break down why ocean freight dominates global trade, how it compares to other transport modes, and why this matters for anyone who relies on the movement of goods around the world.

Ocean Freight: The Backbone of Global Trade

According to data from Statista and the United Nations Conference on Trade and Development (UNCTAD), over 80% of international trade by volume is carried by sea. When measured by weight, no other mode of transport comes close to matching the capacity, efficiency, and scale of ocean freight.

Ships transport everything from raw materials like coal, oil, and grain to manufactured goods packed in millions of containers. Global shipping lanes, extensive port networks, and economies of scale make sea freight the most practical option for moving massive volumes of goods across continents.

Why Does Ocean Freight Dominate?

- Cost efficiency: The per-unit shipping cost via sea is significantly lower than air, rail, or road.

- Capacity: Container ships can carry thousands of tonnes of cargo in a single trip.

- Infrastructure: Global trade routes and port facilities are designed to handle high volumes of ocean freight.

- Versatility: From consumer goods to heavy machinery, ocean freight accommodates a diverse range of cargo types.

This unique combination of low cost, high capacity, established infrastructure, and cargo flexibility is why ocean freight continues to be the backbone of global trade.

How Other Modes of Freight Compare

While ocean freight carries the bulk of global trade by volume, it’s just one piece of the larger logistics puzzle. Other modes of transportation, air, rail, and road, play essential roles in the movement of goods, each offering unique advantages depending on the type of cargo, delivery speed, and geographic needs. Understanding how these modes complement ocean shipping is key to building a resilient, flexible supply chain.

Air Freight

The fastest method of international transport, air freight is indispensable for businesses moving high-value or time-sensitive goods. However, its high costs and limited capacity make it a specialised solution rather than a mass transport method.

- Volume share: Accounts for less than 0.25% of global trade by volume.

- Value share: Despite its small volume, air freight handles 35-40% of global trade by value, reflecting its focus on premium goods.

- Use cases: Electronics, pharmaceuticals, perishable goods, and urgent shipments where speed is non-negotiable.

- Limitations: Air freight is significantly more expensive per kilogram than sea or rail, and offers far less cargo space compared with container ships. It is not a practical solution for bulky or low-margin goods.

For businesses, air freight is about time sensitivity and value density. It’s not used for sheer volume, but when speed is critical, it becomes irreplaceable.

Rail Freight

Rail freight offers a middle ground between ocean and road transport, providing an efficient and cost-effective option for moving large volumes of goods across land, especially in regions with robust rail infrastructure.

- Volume share: Accounts for approximately 9% of global freight transport by tonne-kilometres (tkm).

- Use cases: Bulk commodities (like coal, minerals, and grains), industrial goods, and large freight movements over long distances, particularly across continents (e.g., China-Europe rail corridors).

- Strengths: More energy-efficient than road transport for large volumes and able to handle heavier cargo that would be impractical for air or road.

- Limitations: Dependent on infrastructure. In regions lacking extensive rail systems, its utility is limited. Rail also often requires intermodal transfers to road freight for final delivery.

For businesses operating in landlocked regions or with cross-continental supply chains, rail freight provides a reliable and scalable solution for bulk transport, balancing cost and speed.

Road Freight

Road transport is the most flexible mode of freight, offering door-to-door delivery capabilities that no other method can match. It’s critical for domestic logistics, short-haul cross-border trade, and the all-important “last mile” leg of the delivery process.

- Volume share: Accounts for approximately 18% of global freight transport by tonne-kilometres (tkm).

- Use cases: Retail distribution, courier services, B2B deliveries, and cross-border transport in regions with dense road networks (Europe, North America, Southeast Asia).

- Strengths: Offers unmatched flexibility in routes, schedules, and accessibility to areas not serviced by ports, airports, or rail terminals.

- Limitations: Less efficient for long-haul or bulk shipments compared to rail or sea. Traffic congestion, fuel costs, and emissions are ongoing challenges, particularly in urban areas.

For businesses, road freight is essential for bridging the “first mile” from production sites and the “last mile” to end customers. It’s often the final link that connects other freight modes to the consumer.

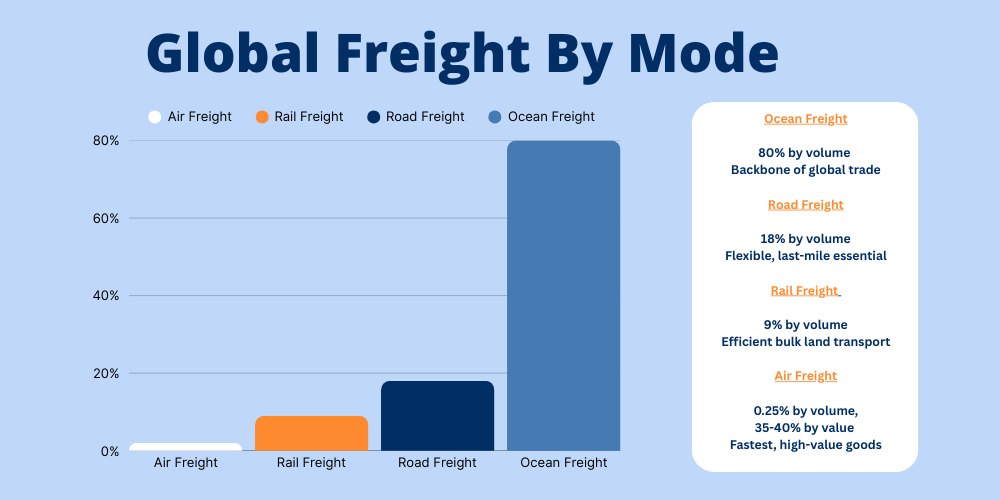

Global Freight Transportation Breakdown (by tonne-kilometres)

Because methodologies differ, shares vary by source and year. The ranges below reflect widely cited benchmarks.

| Transport Mode | Approx. Global Share | Typical Use Case |

|---|---|---|

| Sea (Ocean) | ~70-80% by volume / tonne-km | Large-scale intercontinental trade; bulk commodities; containers |

| Air | <1% by volume but ~35% by value | High-value, time-critical goods (electronics, pharma, perishables) |

| Rail | ~7-12% (region-dependent) | Inland bulk, intermodal corridors, heavy industry lanes |

| Road | ~15-25% (region-dependent) | Domestic distribution, courier networks, last-mile delivery |

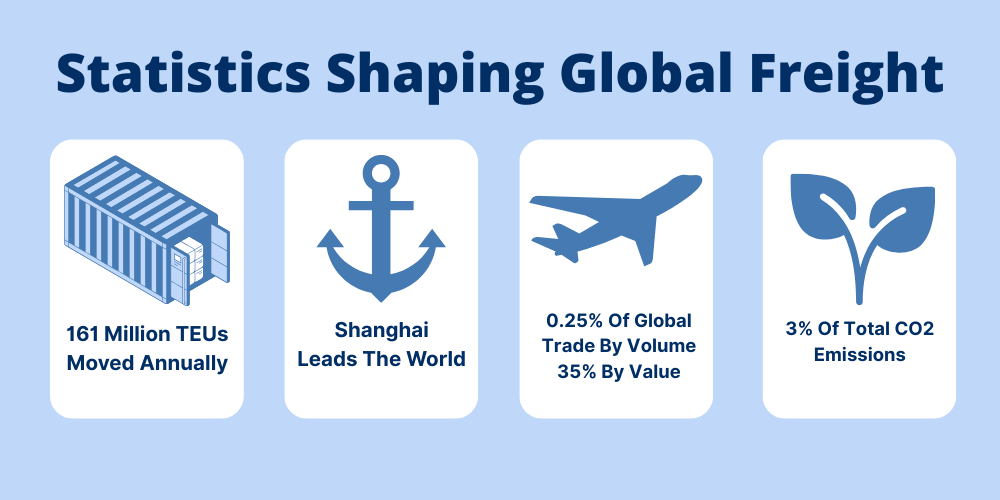

Key Statistics Shaping Global Freight Transport

Global trade is a numbers game, and the figures behind freight movement reveal just how intricate and vital the logistics ecosystem has become. Understanding these key statistics isn’t just about appreciating the scale, it’s about recognising the underlying trends that influence how goods move, how industries operate, and where the future of freight is heading.

- 161 million TEUs moved annually: TEUs (twenty-foot equivalent units) are the standard measure for containerised cargo. This figure reflects the immense flow of goods crossing oceans and fuelling global commerce every day.

- Shanghai leads the world: The Port of Shanghai is the busiest container port, processing over 47 million TEUs each year. As a primary gateway for Chinese exports, its throughput is a bellwether for global manufacturing and trade health.

- Air’s value punch: Although air freight accounts for only an estimated 0.25% of global trade by volume, it represents approximately 35% of global trade by value, a clear sign of its role in moving high-value, time-sensitive goods that justify premium costs.

- Emissions spotlight: The global shipping industry contributes about 3% of total CO₂ emissions, putting environmental sustainability front and centre. This statistic has sparked a wave of innovation focused on green shipping technologies, from alternative fuels to carbon-efficient vessel designs, as the sector works to meet international climate targets.

These figures are more than just data points, they’re indicators of the scale, complexity, and evolving responsibilities of global freight transport. As businesses adapt to shifting consumer demand, environmental pressures, and rapid digitisation, staying across these stats helps teams make smarter, future-proof logistics decisions.

Regional Perspectives on Goods Transportation

While global freight is interconnected, the way goods are moved differs significantly by region. Geography, infrastructure, trade agreements, and economic activity all influence which transport modes dominate. Understanding these dynamics is crucial for businesses optimising logistics strategies and tapping into international markets effectively.

Asia-Pacific

As the hub of global manufacturing, Asia-Pacific is the world’s largest exporter of goods. Countries such as China, Japan, and South Korea rely heavily on ocean freight, with mega-ports like Shanghai, Singapore, and Busan serving as critical gateways. Rail freight is also gaining importance through initiatives like China’s Belt and Road, which expands connectivity between Asia and Europe via extensive overland corridors. These routes offer faster alternatives to sea transport for certain goods and improve access for inland regions.

Europe

Europe boasts one of the most advanced multimodal transport networks, seamlessly integrating sea, rail, and road freight. Its compact geography enables efficient short-sea shipping between neighbouring countries, while major ports such as Rotterdam and Hamburg connect to dense rail and road systems. The EU’s investments in intermodal transport make Europe’s logistics model both flexible and relatively sustainable, setting a benchmark for multimodal integration worldwide.

North America

Road freight dominates domestic logistics in North America, supported by vast interstate highway networks. It plays a crucial role in last-mile and regional deliveries. For international trade, ports like Los Angeles and Long Beach are pivotal ocean gateways, especially for imports from Asia. Once discharged, goods are moved inland via extensive rail systems, essential for covering the long distances across the U.S. and Canada.

Emerging Markets

Regions such as Southeast Asia, Africa, and Latin America are rapidly upgrading logistics infrastructure to meet growing trade demands. Investments in ports, highways, and rail networks are reducing reliance on traditional global hubs. Examples include modernisation of African ports and the Panama Canal expansion, which have opened new trade routes and increased capacity. Combined with fast-growing ecommerce adoption, these regions are set to become increasingly influential players in global freight.

Challenges and Future Trends in Global Freight

Global freight transport is undergoing a significant transformation. While the demand for moving goods across the world continues to rise, the logistics industry faces mounting challenges that require innovative solutions. From environmental concerns to supply chain disruptions and rapid technological advancements, these forces are reshaping how goods are transported and how businesses must adapt to stay competitive.

Sustainability Pressures

The environmental impact of freight transport is a growing concern for governments, businesses, and consumers alike. The global shipping industry is responsible for about 3% of global CO₂ emissions, prompting a collective push towards greener logistics practices.

Efforts to reduce emissions include the adoption of cleaner alternative fuels, such as LNG and biofuels, alongside innovations in vessel design to improve fuel efficiency. Additionally, carbon offset programs are becoming more common as businesses seek to align with environmentally conscious consumer values. Regulatory initiatives like the IMO 2030 emissions targets are accelerating this shift, making sustainability not just an ethical priority but also a compliance necessity for the logistics sector.

Supply Chain Resilience

The past few years have exposed the vulnerabilities of global supply chains. Events such as the COVID-19 pandemic, geopolitical conflicts, and capacity bottlenecks have disrupted trade routes and highlighted the risks of relying on single-source suppliers or transport corridors.

As a result, businesses are rethinking their logistics strategies, focusing on diversified transport networks, building redundancy into supply chains, and seeking more agile, flexible logistics solutions. This shift towards resilience is crucial for mitigating future disruptions and maintaining business continuity in an increasingly unpredictable global landscape.

Digitisation and Automation

Technology is playing a pivotal role in reshaping freight logistics. Innovations such as AI-driven route optimisation, digital freight marketplaces, and smart port infrastructure are enhancing operational efficiency, reducing costs, and providing greater transparency across supply chains.

Automation in warehouses, predictive analytics for demand forecasting, and blockchain for secure documentation are streamlining previously manual and time-consuming processes. These advancements enable businesses to respond more quickly to market changes, optimise delivery times, and gain real-time visibility into their logistics operations.

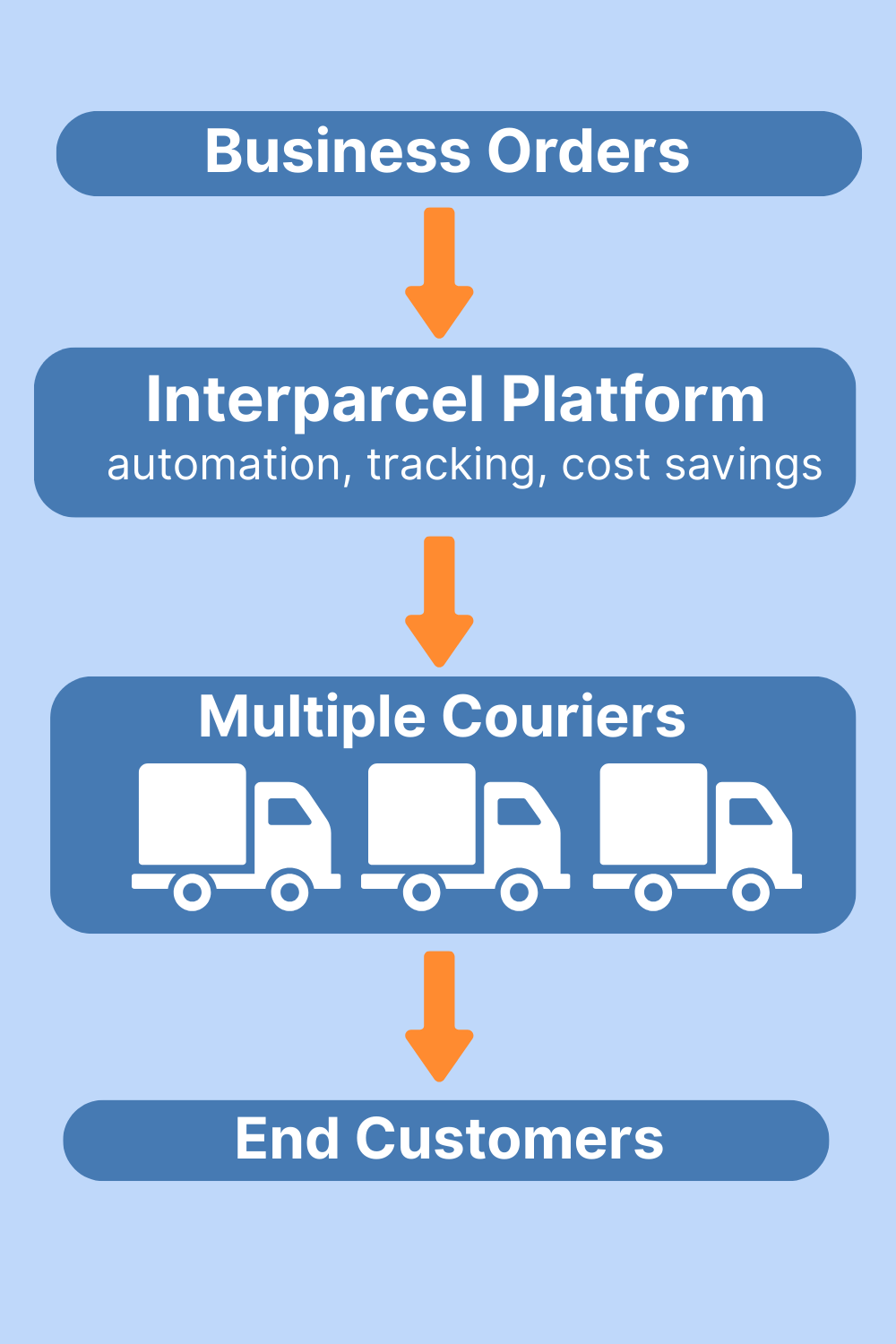

Simplifying Global Shipping for Businesses

For businesses, understanding how goods are transported globally isn’t just academic, it directly impacts logistics strategies, cost structures, and customer service. As supply chains grow more complex, many SMEs are turning to multi-carrier shipping platforms to simplify fulfilment and build flexibility into their operations.

Platforms like Interparcel give businesses access to multiple courier services through a single interface. They can automate routine shipping tasks, generate labels and documents in seconds, and provide customers with real-time branded tracking, all without lock-in contracts or subscription fees.

This level of flexibility is becoming essential as businesses face fluctuating shipping costs, evolving customer expectations, and growing demand for faster, more transparent delivery experiences.

The World Runs on Ocean Freight, But Logistics Is Evolving

While ocean freight remains the dominant way goods move worldwide, every mode of transport, air, rail, and road, plays a critical role in the global logistics network. As technology advances and new challenges emerge, businesses that embrace smarter, more adaptable shipping strategies will be best positioned to thrive.

Understanding these freight dynamics is no longer the sole domain of supply chain managers, it’s essential knowledge for any business engaged in international trade.

Are you affected by the Sendle service suspension? We have an immediate shipping solution for you!

Are you affected by the Sendle service suspension? We have an immediate shipping solution for you!

Facebook

Facebook Twitter

Twitter Instagram

Instagram Linked In

Linked In YouTube

YouTube