If you’re shipping from Australia to the U.S., things have changed. Since late August 2025, the USD $800 de minimis threshold has been suspended. This means every parcel, regardless of value, is now subject to duties and taxes.

How those duties are handled depends on the clearance path:

- Postal shipments (Australia Post → USPS): Must be sent Prepaid Duties & Taxes (PDDP). This is where Zonos comes in , calculating and billing duties/taxes upfront.

- Courier shipments (UPS, FedEx, DHL): You still have flexibility. Merchants can ship DDP (prepay duties and taxes) or DDU (customer pays on delivery).

This guide explains exactly how Zonos works with Australia Post to simplify postal shipments into the U.S., how to set it up, and what it costs.

Jump to:

- What Is Zonos and Why Does It Matter?

- Understanding PDDP vs DDP vs DDU

- The US Shipping Process With Australia Post + Zonos

- How to Set Up Zonos With Australia Post

- Start Shipping with PDDP to the U.S.

- Fees & Billing Frequency

- Keep Your U.S. Orders Moving Smoothly

What Is Zonos and Why Does It Matter?

Zonos is a cross-border technology platform that takes the guesswork out of duties and taxes.

When integrated with Australia Post for U.S. shipments, Zonos:- Calculates an estimate of the duties and taxes for international shipments based on product details (HS code, item value, country of origin, shipping costs).

- Bill the merchant directly, so you cover the costs upfront.

- Passes clearance-ready data to USPS and CBP, avoiding parcels being held at the border.

For postal shipments, Zonos isn’t optional , it’s the mechanism that allows Australia Post parcels to comply with U.S. import requirements.

Understanding PDDP vs DDP vs DDU

It’s easy to confuse the acronyms, so let’s break them down:

- PDDP (Postal Delivered Duty Paid): Required for postal shipments with Australia Post → USPS. Zonos calculates and bills these charges before parcels are handed over.

- DDP (Delivered Duty Paid): Used by couriers. Duties and taxes are prepaid by the sender, creating a smooth delivery experience.

- DDU (Delivered Duty Unpaid): Also courier-only. Duties and taxes are billed to the customer on delivery.

With Australia Post, PDDP is mandatory. With couriers, you choose between DDP or DDU , you can learn more about this and the two clearance paths in our Shipping to the US: Two Clearance Paths Explained.

The US Shipping Process With Australia Post + Zonos

When you ship to the U.S. with Australia Post + Zonos:

- Create a Zonos® Verified Account and link it to your Australia Post Business account (instructions below).

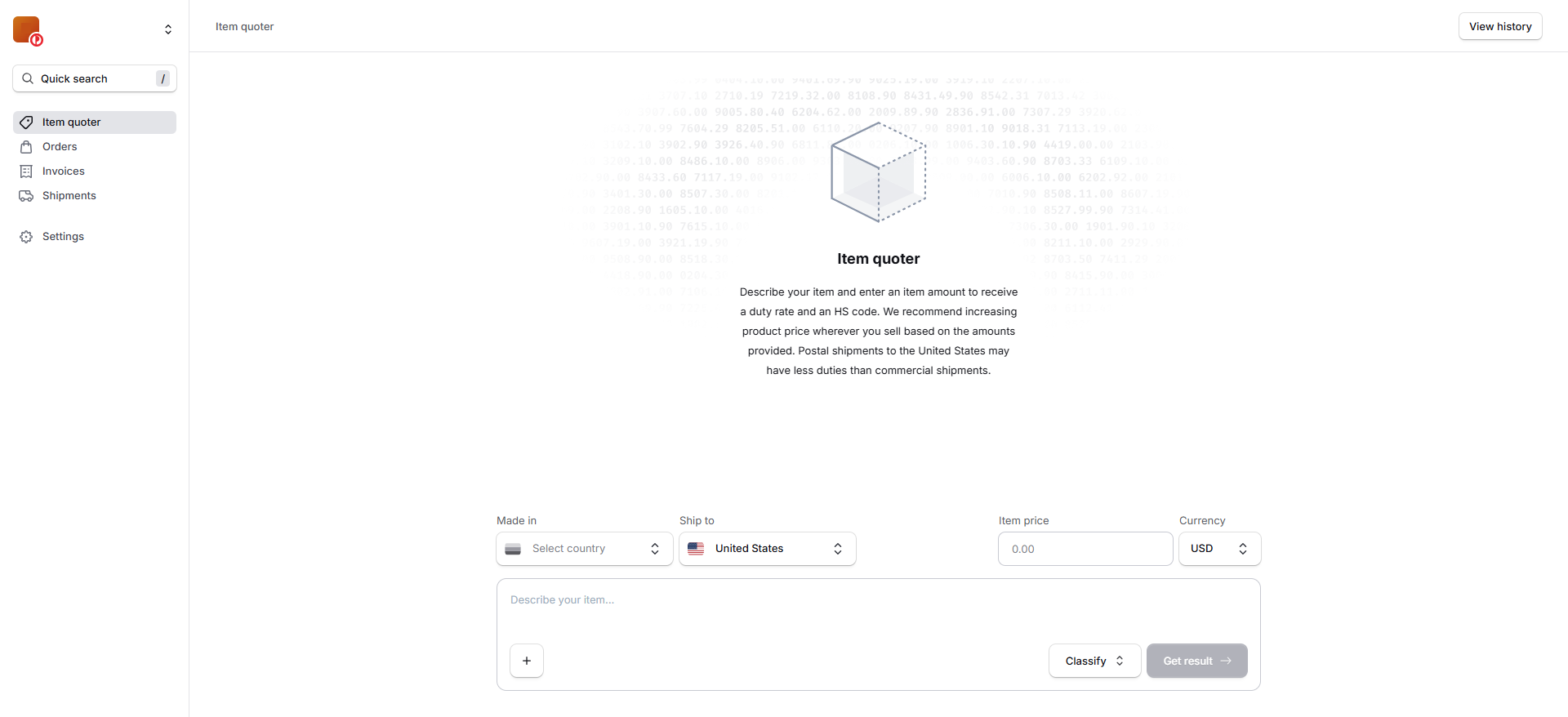

- Use the free Zonos tools to calculate duty costs: If you’re not already showing duties at checkout, these tools let you calculate them in advance. Once you know the duties and fees, you can adjust your product or shipping prices as needed. Watch this video to learn how:

- You can then process your orders directly through the Australia Post portal or via a third-party platform like Interparcel. For all shipments booked with your business account, Australia Post will send the shipment data to Zonos.

- Zonos will bill you daily for the duties and fees on shipments associated with your Zonos Verified Account. Zonos bills you within 24 hours of getting the shipment data from Australia Post (note that this can be several days after you ship). You can see these invoices in your Dashboard.

- Australia Post transports the parcel to USPS in the U.S.

- Customs clearance is automatic because CBP already has duties/taxes paid.

- Your customer receives the parcel.

With couriers, clearance depends on your choice of DDP or DDU, but with postal, PDDP is the only path.

How to Set Up Zonos With Australia Post

Retailers need to set up a Zonos Verified Account to keep their U.S. volumes moving with Australia Post.

Before you begin.

To avoid creating duplicate accounts, check if your organisation already has an Australia Post Account connected to Zonos:

- In your Zonos Dashboard, click your store ID (located in the top left corner). If there is an account linked to your Zonos account, you will see it with the Australia Post logo. (Screenshot)

- If you don’t see it, continue with the steps below.

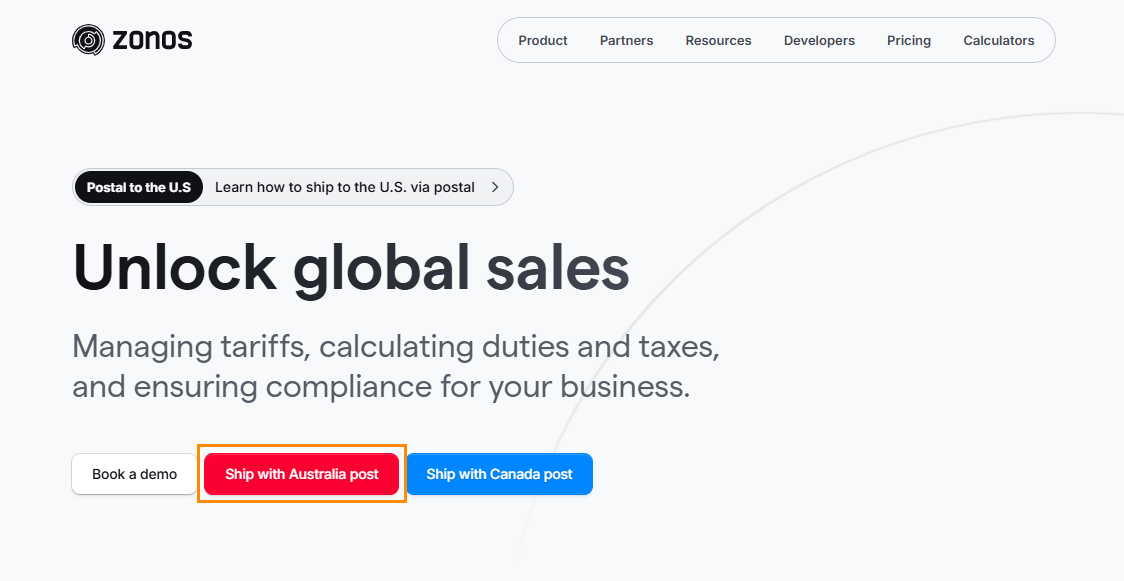

- Head to zonos.com and select Ship with Australia Post.

- Click Start today and complete the registration form. You’ll be asked to verify your account by email and phone number.

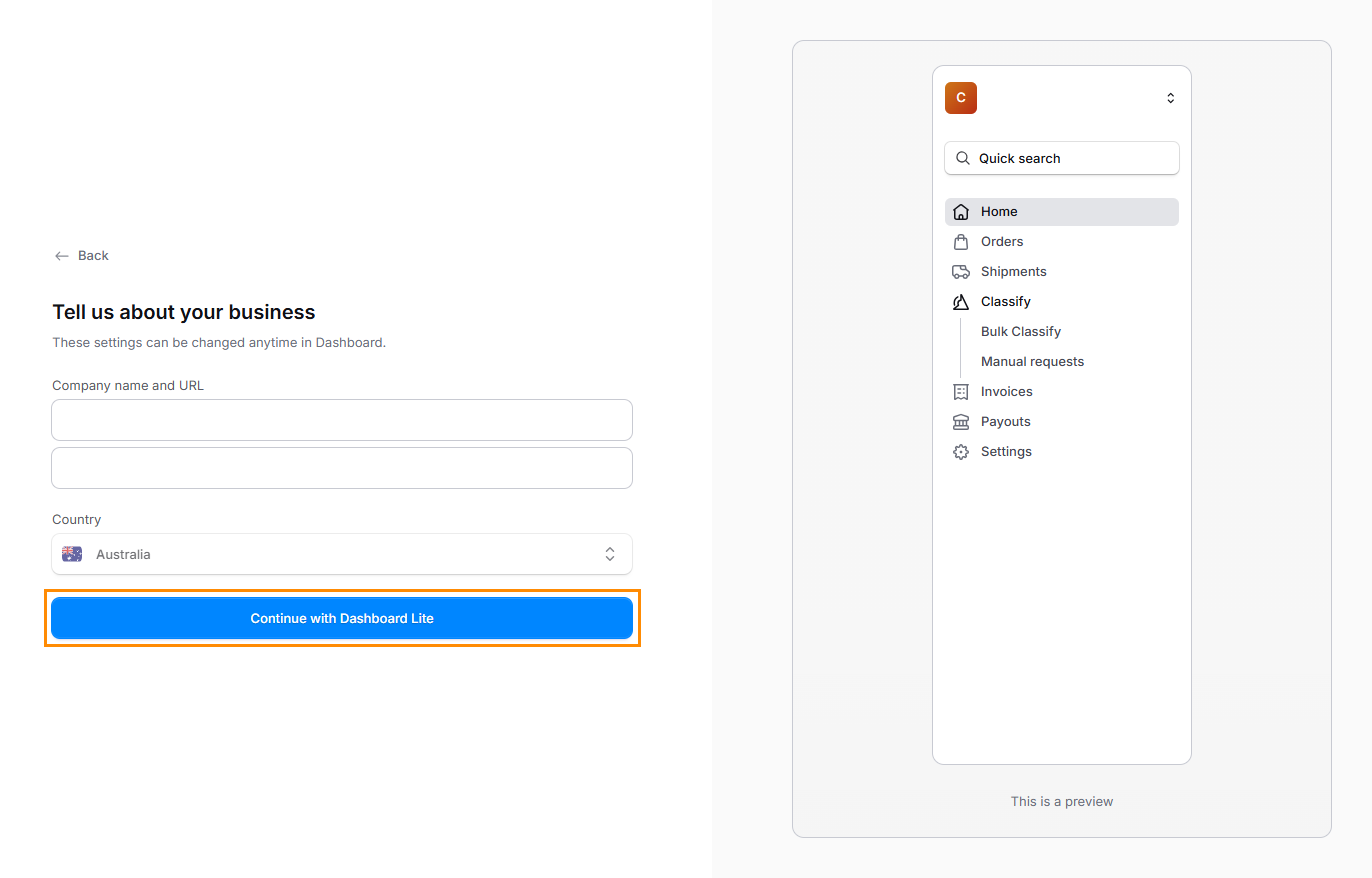

- Enter your Company Name and URL, then click Continue with Dashboard Lite.

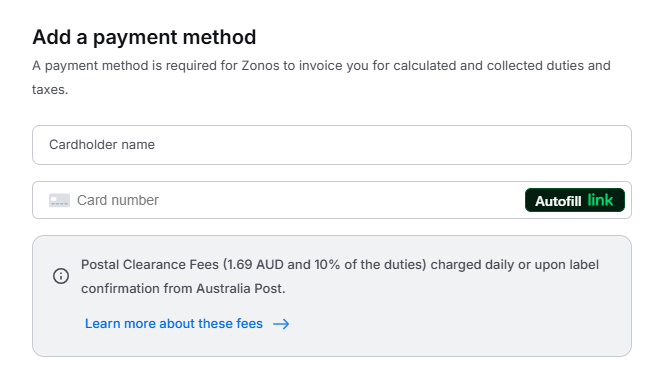

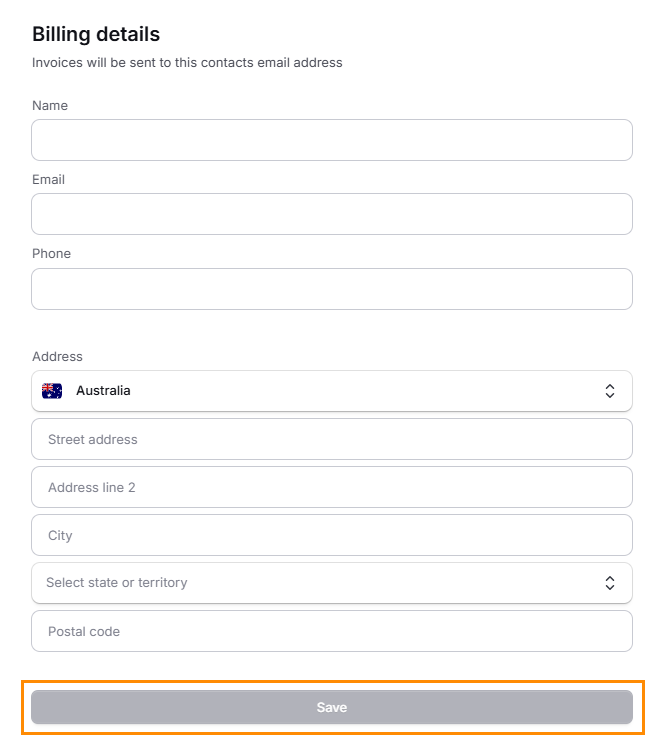

- Add a payment method. Creating an account is free, but you’ll need a payment method on file to cover duties, taxes, and postal clearance fees.

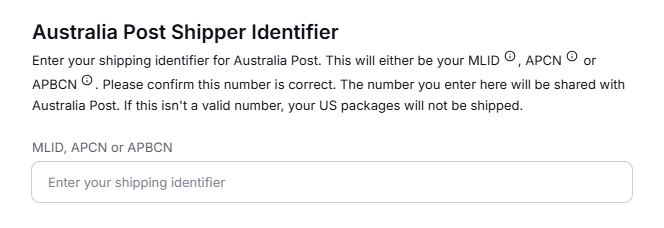

- On the same page, add your Australia Post shipping business details. You’ll be asked for either an MLID for Parcel Contract (eParcel) customers, or the APCN/APBCN for MyPost Business customers.

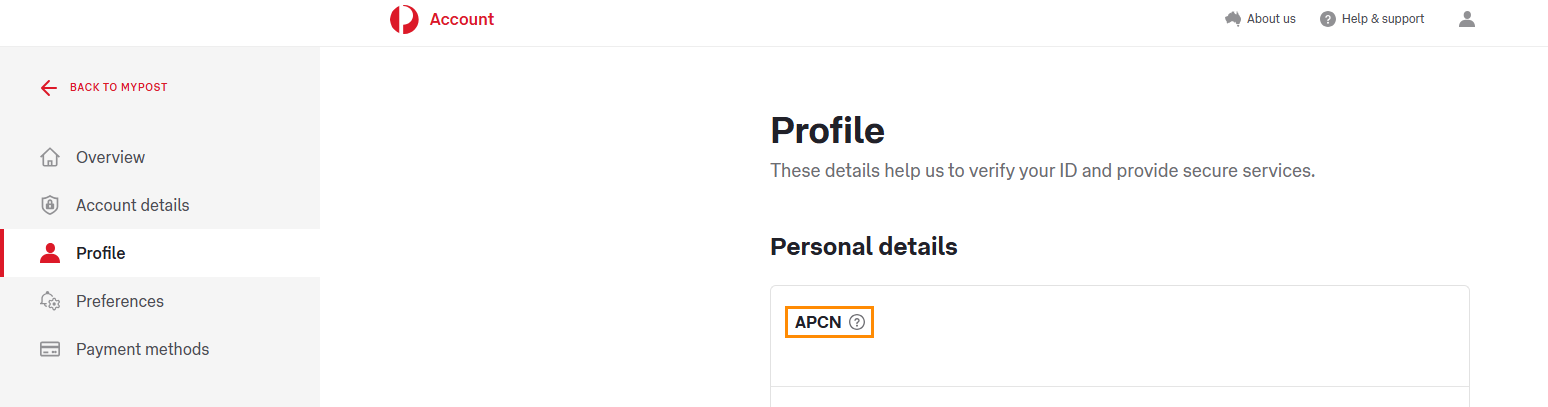

You can find the APCN number on your profile details.

You can find the APCN number on your profile details. - Finish adding your Billing Details on the registration form page, then click Save.

- Once linked, you’ll have a separate Zonos dashboard alongside your Australia Post or Interparcel account. From here, you can view charges, manage shipments, and track customs costs.

How to Set Up Zonos With Australia Post.

Important Information

If your Australia Post shipments aren’t linked to a Zonos® Verified Account, or if the registration details you provided are invalid, duties cannot be paid to U.S. Customs, meaning parcels may be returned and additional processing fees could apply.

To keep your shipments moving smoothly after setting up a Zonos® Verified Account, make sure you lodge a manifest on time. Parcels without a valid manifest may be returned to the sender if one isn’t provided within 3 business days.

Start Shipping with PDDP to the U.S.

If you’re shipping to the U.S. through Interparcel with Australia Post and Zonos, duties and taxes are billed directly to your Zonos payment method. This means your parcels travel with Prepaid Duties & Taxes (PDDP), ensuring USPS delivers them without unexpected charges or delays.

To make sure charges are correct, it’s important your product data , including HS codes, descriptions, and item values , is accurate. Zonos relies on this information to calculate customs fees.

For everything else , like connecting your Australia Post account and managing shipments , you can follow our shipping tools guides. We’ve created step-by-step instructions for:

These guides will show you how to import your orders, book shipments, and print labels directly from the Interparcel platform.

Fees & Billing Frequency

For Australia Post users, if you use the Zonos integration, all postal parcels shipped to the U.S. with a value of USD $800 or under will be charged a postal clearance fee.

- Postal clearance fee: AUD $1.69 + 10% of the duty amount - for bound shipment (from Australia to the U.S.)

- Duties and fees are invoiced daily or upon label confirmation from Australia Post.

Keep Your U.S. Orders Moving Smoothly

The suspension of the U.S. de minimis threshold has changed how Australian retailers approach cross-border shipping via postal services. For postal shipments, Prepaid Duties & Taxes (PDDP) via Zonos is now mandatory.

Whether you’re shipping through MyPost Business or Parcel Contract (eParcel) directly, or via Interparcel this setup ensures your duties, taxes, and postal clearance fees are handled upfront.

Facebook

Facebook Twitter

Twitter Instagram

Instagram Linked In

Linked In YouTube

YouTube